Structure Selector Pro (888)553-7839

With Structure Selector Pro, you can confidently establish the right business structure and start a banking relationship

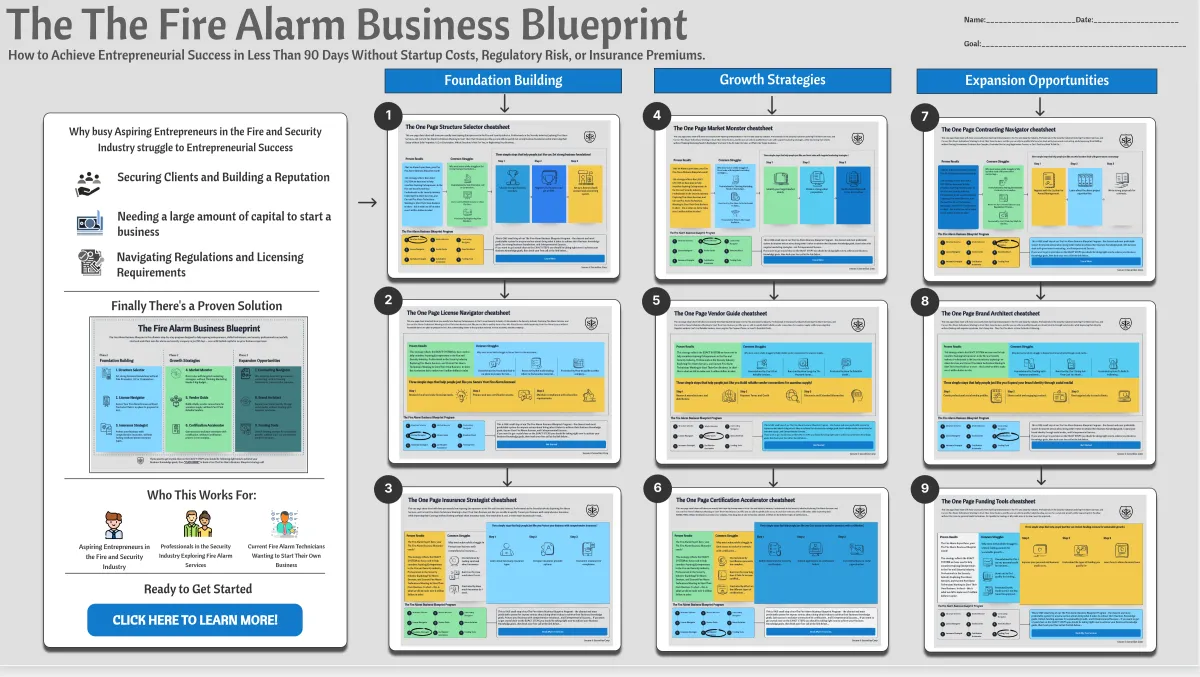

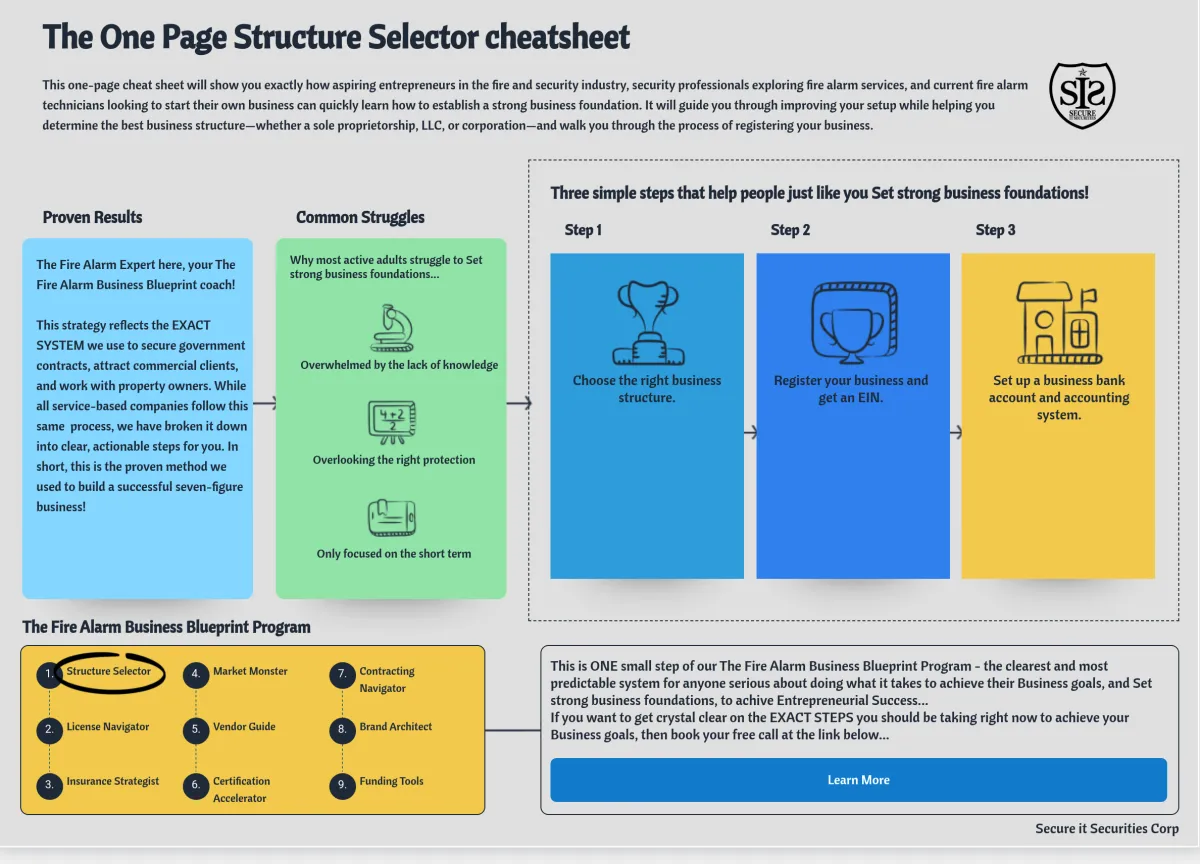

Three simple steps that help people just like you Setup the right type of business structure!

Turn volume on when you play this video

FEEDBACK FROM SOME OF THE MANY CUSTOMERS WHO TRUST OUR POWERFUL SYSTEMS

Jason M. – Newark, NJ

Structure Selector Pro gave me the clarity I needed to legally and properly form my fire alarm business.

Melissa T. – Orlando, FL

This course is exactly what I needed. Anthony breaks down everything in a simple, actionable way.

Kevin R. – Brooklyn, NY

The Structure Selector Pro module saved me from making some costly mistakes.

THIS will guide you through improving your setup while helping you determine the best business structure

Not Understanding The Different Types Of Business Structures

Many entrepreneurs fail to research the pros and cons of different business structures, leading to costly tax implications and limited liability protection.

Frustrated Cant Get AN EIN FOR FREE

Many entrepreneurs search online and get directed to paid services that charge fees to apply for an EIN, even though the IRS issues EINs for free. These sites often look official, leading people to believe that payment is required.

Worrying if they opened the wrong bank accounts

Most entrepreneurs are experts in their craft or service—not in banking. Without formal training in business finance, many are unaware of the different account types available or how each one functions.

3 Simple Steps

Choose the right business structure.

The right structure, like an LLC or corporation, can separate your personal assets from your business liabilities. This means if your business is ever sued or falls into debt, your home, savings, and other personal property are protected.

Register your business and get an EIN.

A business needs an EIN (Employer Identification Number) to legally identify itself for tax purposes, open a business bank account, hire employees, and file business tax returns—making it a critical step in establishing and operating a legitimate company.

Set up a business bank account and accounting system.

Opening the right business accounts is essential for managing your finances, building credibility, and keeping your operations organized. From a dedicated business checking account to a savings account for taxes and reserves, the right setup helps separate personal and business expenses, simplifies bookkeeping, and makes you bank-ready for loans, payroll, and growth opportunities.

HERE'S EVERYTHING YOU GET WHEN YOU ORDER TODAY:

Lifetime License To The Structure Selector Course- ($10,000.00 Value)

Complete Structure Selector Training Program - ($5000.00 Value)

LIFETIME Membership to The Fire Alarm Business Blueprint Private Community - ($25,000.00 Value)

Total Value: $40,000.00

Get It All Right Now

ONLY $97!

NEW BONUS JUST ADDED - $49 The Fire Alarm Business Blueprint eBook!

The Fire Alarm Business Blueprint is the ultimate step-by-step program designed to help aspiring entrepreneurs, skilled technicians, and security professionals successfully start and scale their own fire alarm and security company in just 90 days – even with limited capital or no prior business experience.

HERE'S EVERYTHING YOU GET WHEN YOU ORDER TODAY:

Lifetime License To The Structure Selector Course- ($10,000.00 Value)

Complete Structure Selector Training Program - ($5000.00 Value)

LIFETIME Membership to The Fire Alarm Business Blueprint Private Community - ($25,000.00 Value)

Total Value: $40,000.00

Get It All Right Now

ONLY $97!

YOUR PURCHASE IS BACKED BY OUR 30 DAY MONEY BACK GUARANTEE!

"Spend a full 30 days leveraging and testing this powerful program and if you're not 100% satisfied for any reason, we'll issue a full refund.

HERE'S EVERYTHING YOU GET WHEN YOU ORDER TODAY:

Lifetime License To The Structure Selector Course- ($10,000.00 Value)

Complete Structure Selector Training Program - ($5000.00 Value)

LIFETIME Membership to The Fire Alarm Business Blueprint Private Community - ($25,000.00 Value)

Total Value: $40,000.00

Get It All Right Now

ONLY $97!

YEAH BUT FOR JUST $97 HOW GOOD CAN THIS BE?

We priced this course at just $97 because we believe every aspiring business owner no matter their budget deserves access to the right tools from day one. Most people spend hundreds or even thousands on accountants, formation services, or fixing mistakes that could’ve been avoided with the right knowledge.

Frequently Asked Questions:

What exactly will I learn in Structure Selector Pro? You'll learn how to choose the right business structure

Do I need any prior business experience to take this course? Structure Selector Pro was designed for both brand-new entrepreneurs and existing business owners

Why is the course only $97? What’s the catch? We intentionally priced the course low to make it accessible for anyone serious about starting a business the right way.

HERE'S EVERYTHING YOU GET WHEN YOU ORDER TODAY:

Lifetime License To The Structure Selector Course- ($10,000.00 Value)

Complete Structure Selector Training Program - ($5000.00 Value)

LIFETIME Membership to The Fire Alarm Business Blueprint Private Community - ($25,000.00 Value)

Total Value: $40,000.00

Get It All Right Now

ONLY $97!

***DISCLAIMER: The information provided in this course, program, or material is for educational and informational purposes only and is not intended to serve as legal, tax, or financial advice. Secure It Securities Corp and its affiliates are not attorneys, certified public accountants, or licensed financial advisors.